Decoding the World of Forex Trading: Uncovering the Importance of Brokers in Guaranteeing and managing threats Success

In the detailed realm of forex trading, the role of brokers stands as a crucial component that commonly stays shrouded in mystery to many ambitious traders. The significance of brokers surpasses simple transaction assistance; it includes the world of threat administration and the overall success of trading ventures. By turning over brokers with the task of navigating the complexities of the foreign exchange market, investors can possibly open a realm of possibilities that might or else remain evasive. The elaborate dancing between traders and brokers reveals a symbiotic connection that holds the vital to deciphering the secrets of successful trading ventures.

The Duty of Brokers in Forex Trading

Brokers play a crucial function in foreign exchange trading by supplying vital solutions that aid investors take care of threats effectively. These monetary middlemans work as a bridge in between the traders and the foreign exchange market, supplying an array of solutions that are vital for navigating the complexities of the fx market. One of the main features of brokers is to supply investors with accessibility to the marketplace by facilitating the implementation of professions. They offer trading systems that permit investors to sell and buy money sets, offering real-time market quotes and making certain speedy order implementation.

Furthermore, brokers offer utilize, which makes it possible for traders to control larger positions with a smaller sized quantity of capital. While leverage can enhance profits, it additionally enhances the potential for losses, making threat monitoring vital in forex trading. Brokers give danger monitoring devices such as stop-loss orders and limit orders, permitting traders to establish predefined exit indicate reduce losses and secure earnings. Additionally, brokers use academic sources and market analysis to assist investors make notified decisions and establish effective trading strategies. Generally, brokers are essential companions for traders aiming to navigate the forex market successfully and handle threats efficiently.

Risk Administration Methods With Brokers

Offered the important duty brokers play in facilitating access to the fx market and supplying danger management tools, comprehending effective techniques for handling dangers with brokers is crucial for successful forex trading. One essential technique is setting stop-loss orders, which enable traders to determine the optimum quantity they want to shed on a trade. This tool helps limit potential losses and safeguards versus adverse market movements. Another vital risk monitoring strategy is diversification. By spreading out financial investments across various money sets and possession classes, traders can lower their direct exposure to any kind of solitary market or instrument. Additionally, making use of leverage cautiously is essential for risk monitoring. While utilize amplifies earnings, it likewise magnifies losses, so it is essential to utilize take advantage of sensibly and have a clear understanding of its implications. Last but not least, preserving a trading journal to track efficiency, assess past trades, and recognize patterns can assist investors refine their methods and make even more enlightened choices, ultimately boosting risk monitoring methods in foreign exchange trading.

Broker Choice for Trading Success

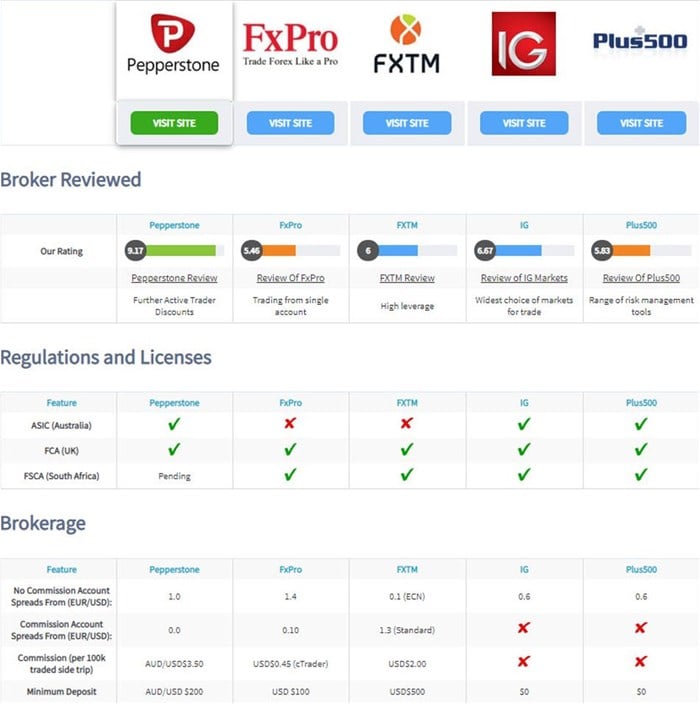

Choosing the ideal broker is extremely important for achieving success in forex trading, as it can significantly impact the total trading experience and results. When selecting a broker, a number of essential elements should be taken into consideration to ensure a fruitful trading trip. One crucial facet to review is the broker's regulative conformity. Working with a regulated broker provides a layer of protection for traders, as it guarantees that the broker operates within established criteria and standards, therefore decreasing the risk of fraudulence or malpractice.

Additionally, investors should examine the broker's trading system and tools. An easy to use system with sophisticated charting devices, fast profession execution, and a series of order types can improve trading effectiveness. Furthermore, examining the broker's client assistance services is necessary. Trigger and trustworthy customer support can be vital, especially during unstable market problems or technological issues.

Furthermore, traders ought to evaluate the broker's fee framework, consisting of spreads, payments, and any kind of hidden charges, to comprehend the expense ramifications of trading with a specific broker - forex brokers. By very carefully reviewing these factors, traders can select a broker that aligns with their trading objectives and establishes the stage for trading success

Leveraging Broker Competence commercial

How can traders properly harness the experience of their selected brokers to optimize profitability in foreign exchange trading? Leveraging broker expertise for revenue calls for a strategic technique that includes understanding and making use of the services used by the broker to boost trading results.

Developing a great connection with a broker can lead to customized recommendations, profession suggestions, and risk management strategies tailored to individual trading designs and objectives. By communicating on a regular basis with their brokers and looking for input on trading approaches, investors can tap right into skilled understanding and improve their overall efficiency in the foreign exchange market.

Broker Help in Market Evaluation

Broker aid in market evaluation expands beyond just technological analysis; it my latest blog post also includes fundamental evaluation, belief analysis, and risk monitoring. By leveraging their experience and accessibility to a variety of market information and research study tools, brokers can aid investors navigate the intricacies of the foreign exchange market and make knowledgeable decisions. In addition, brokers can supply timely updates on economic events, geopolitical advancements, and various other elements that might impact money costs, enabling investors to stay in advance of market fluctuations and readjust their trading settings accordingly. Eventually, by utilizing broker aid in click here for more info market analysis, traders can improve their trading performance and boost their chances of success in the affordable forex market.

Final Thought

In final thought, brokers play an essential duty in forex trading by taking care of risks, supplying expertise, and helping in market evaluation. Selecting the appropriate broker is important for trading success and leveraging their expertise can result in earnings. forex brokers. By utilizing danger monitoring methods and functioning very closely with brokers, traders can browse the complex world of foreign exchange trading with self-confidence and enhance their possibilities of success

Offered the vital duty brokers play in helping with accessibility to the international exchange market and providing risk administration devices, understanding effective methods for taking care of risks with brokers is necessary for effective foreign exchange trading.Picking the right broker is critical for achieving success in forex trading, as it can substantially influence the overall trading experience and outcomes. Working with a regulated broker provides a layer of safety for investors, as it makes certain that the broker runs within established standards and requirements, thus decreasing the danger of fraud or malpractice.

Leveraging broker proficiency for profit requires a strategic approach that involves understanding and using the solutions supplied by the broker to improve trading see this site results.To successfully take advantage of on broker competence for profit in forex trading, investors can count on broker help in market analysis for informed decision-making and danger reduction techniques.